videorulet.ru

Market

Do Spy Apps Work

Spy apps can indeed record phone calls and text messages, but their capabilities vary depending on the specific app. Apps like FlexiSpy and. Do not copy all data. Choose only trusted files. Moreover, do not copy full folders but check what is inside of them. Otherwise, you could transfer the spyware. Invasive apps use a phone's built-in functionality to spy and gather information on you. Spyware is malware that can maliciously steal information by working. How do you remove spyware? · Run a full scan on your computer with your anti-virus software · Run a legitimate product specifically designed to remove spyware. Unusual phone behavior, such as overheating when idle, weird sounds during calls, or increased data use, are signs that your phone is infected with spyware. Our spy mobile app is considered the best choise that you can make because of its complex features. WhatsApp, Facebook, Viber or Snapchat are use as the main. Spyware on Android can secretly track your activity & send your data to cybercriminals. Learn how to detect & remove spyware on Android. Spy apps operate silently in the background with other phone applications. Usually, no notifications are sent to the monitored phone to keep its functions. I dont have the money to try one to make sure. Yes, most likely they're scams. However there are firms like NSO group that sell software to. Spy apps can indeed record phone calls and text messages, but their capabilities vary depending on the specific app. Apps like FlexiSpy and. Do not copy all data. Choose only trusted files. Moreover, do not copy full folders but check what is inside of them. Otherwise, you could transfer the spyware. Invasive apps use a phone's built-in functionality to spy and gather information on you. Spyware is malware that can maliciously steal information by working. How do you remove spyware? · Run a full scan on your computer with your anti-virus software · Run a legitimate product specifically designed to remove spyware. Unusual phone behavior, such as overheating when idle, weird sounds during calls, or increased data use, are signs that your phone is infected with spyware. Our spy mobile app is considered the best choise that you can make because of its complex features. WhatsApp, Facebook, Viber or Snapchat are use as the main. Spyware on Android can secretly track your activity & send your data to cybercriminals. Learn how to detect & remove spyware on Android. Spy apps operate silently in the background with other phone applications. Usually, no notifications are sent to the monitored phone to keep its functions. I dont have the money to try one to make sure. Yes, most likely they're scams. However there are firms like NSO group that sell software to.

Spy apps offer a range of powerful capabilities, from tracking location and monitoring text messages to accessing social media activities. They. Do spy apps really work? Absolutely, but their efficacy hinges on the brand and its commitment to quality. Reputable spy apps, like Qustodio and Norton Family. Invasive apps use a phone's built-in functionality to spy and gather information on you. Spyware is malware that can maliciously steal information by working. Phone spy applications, also known as monitoring or tracking apps, operate discreetly to collect and monitor data from a target device. Yes, mobile spy applications do work. The main purpose of such an application is to keep an eye on your target. Spyware on Android can secretly track your activity & send your data to cybercriminals. Learn how to detect & remove spyware on Android. With mSpy, you can keep them safe without being detected. The app works in the background mode and doesn't affect the functionality of the target device in any. I don't know the name of any of the software, I just know they do it. I don't do anything private on work stuff. I mean anything. I have. If you find spy apps on devices of (possible) victims of a crime, it is important not to remove the app immediately or to restrict access to the app. This could. Cell phone spy apps function in the background and leave no trace of their presence. Such apps do not send any notification or pop-up to the target device. Spy apps use their share of processing power to track your phone. Unlike many others on this list, this is not a dead-giveaway sign of spyware. You may not. To access your phone activity, the person monitoring you signs in to a website or app on a different device. They may also receive notifications of certain. Do you want to track your loved one cell phone? Here is a good solution for you! Use link on bio and monitor every call, SMS, GPS, photo. This may be because they are using spyware to track your location and access your computer or mobile phone. This is commonly known as stalker ware or spouseware. Do spy app work on iPhone. Reply. 3. Prince Victor Ette . Thank Epic - Joystock · Spy Apps for Jailbroken Iphone · Best Spy Apps to. While it's tempting to want to spy on your kid, your employee or your spouse using these spy apps, it's probably one of the riskiest things. The installed software, like FinFisher, can allow them to snoop on Facebook and Skype, as well as go through your emails. And if governments can do it, you can. What Can a Spy App Do? A spy app can monitor phone calls, text messages, GPS location, social media activity, and internet browsing history. Spy apps are also classified as software that allows us to remotely scan someone's texts and call records. These are designed in such a way that they collect. There is zero chance that the client will find out that you are using a hidden spy app to monitor their data. This sums up spying in its purest.

How To Use Form 1099

When there is an amount shown on your Form MISC in Box 7, you're typically considered self-employed. Note: Starting in tax year (for forms furnished. How to Prepare and File Form ? · Obtain a blank form (which is printed on special paper) from the IRS or an office supply store. · Fill out the Form is used to report certain types of non-employment income to the IRS, such as dividends from a stock or pay you received as an independent contractor. A form is part of a series of tax documents used to report payments made to non-employees (ie, independent contractors, freelancers, or sole proprietors). We mail your Form G by January 31 of the year after you received the refund. Or, use our G Lookup tool. G Lookup. Medium. Form G - Things to. The Department of Revenue's G only applies to individuals who itemize their deductions on their income tax return. If you claimed the standard deduction. Payers use Form NEC to report business-related nonemployee compensation paid to independent contractors and backup withholding of federal income taxes. Let's explore what a form is, common versions, who is expected to receive one, and how to simplify the process of filling it out and sending it. This blog. As a recipient or payee, navigate to Item 2 to find out more on filing your tax return with a form. As an issuer or payer, see Item 3 on how to supply. When there is an amount shown on your Form MISC in Box 7, you're typically considered self-employed. Note: Starting in tax year (for forms furnished. How to Prepare and File Form ? · Obtain a blank form (which is printed on special paper) from the IRS or an office supply store. · Fill out the Form is used to report certain types of non-employment income to the IRS, such as dividends from a stock or pay you received as an independent contractor. A form is part of a series of tax documents used to report payments made to non-employees (ie, independent contractors, freelancers, or sole proprietors). We mail your Form G by January 31 of the year after you received the refund. Or, use our G Lookup tool. G Lookup. Medium. Form G - Things to. The Department of Revenue's G only applies to individuals who itemize their deductions on their income tax return. If you claimed the standard deduction. Payers use Form NEC to report business-related nonemployee compensation paid to independent contractors and backup withholding of federal income taxes. Let's explore what a form is, common versions, who is expected to receive one, and how to simplify the process of filling it out and sending it. This blog. As a recipient or payee, navigate to Item 2 to find out more on filing your tax return with a form. As an issuer or payer, see Item 3 on how to supply.

Those same organizations also send a copy to the IRS, so it's important that you report all taxable income from your forms. Types of forms. There are. The K form is an informational document required by the United States' IRS for Stripe accounts that meet specific criteria. You'll need this form to file your taxes. Learn more about how to verify your tax information and receive your form below. Click “R Summary” under My Payroll Information. Follow the prompts to access your R Form for the tax year that just ended. You will also be able to. Form MISC tax form is used to report many types of income. The main types – like income from rents or royalties – usually require the use of additional. The IRS Form MISC changes result from the use of a separate IRS Form NEC to report $+ of nonemployee compensation (NEC) paid to independent. You must include the form with your tax return and include the benefits you were paid in your earnings for the applicable calendar year. If you use a tax. This income may include interest from your bank, dividends from investments, or compensation for freelance work. Issuers of forms must send one copy to the. Use the State and Local Income Tax Refund Worksheet in the federal Form instructions to determine whether your Wisconsin tax refund must be reported as. I had to use a this year and it was simple to use. MikeyHey. Phoenix, AZ Self-employment income (Form NEC, Form MISC, and Schedule C). When there is an amount shown on your Form MISC in Box 7, you're typically considered self-employed. Note: Starting in tax year (for forms furnished. As a recipient or payee, navigate to Item 2 to find out more on filing your tax return with a form. As an issuer or payer, see Item 3 on how to supply. The Internal Revenue Service Form is used to report various types of income other than wages, salaries, and tips. Unfortunately, fraudsters steal or purchase private information from illicit data brokers and use that information to file fraudulent unemployment claims. While. To ensure receipt of W-2s and s, use Michigan Treasury Online (MTO). You will receive a confirmation number when your upload is transmitted successfully. Use Form INT in the calculation of your federal adjusted gross income. What should I do if I received interest on a refund from the Department, but did not. Click “R Summary” under My Payroll Information. Follow the prompts to access your R Form for the tax year that just ended. You will also be able to. The NEC forms cannot be transmitted via the Combined Federal/State program for the filing year. However, for the filing year and forward, the. Unemployment BenefitsFile Form G for unemployment income. included for I had to use a this year and it was simple to use. MikeyHey. Phoenix. Therefore, your Form G is correct as issued. For information on how to report the income and deduct your payment on your federal return, contact the.

Ways To Make A Free Website

How to build a business website · Launch Canva. Open Canva and search for “Business Website” to start creating a website for your business. · Select a business. Pick a blog name. Choose a descriptive name for your blog. Get your blog online. Register your blog and get hosting. Customize your blog. Choose a free blog. How to make a free website · Sign up for a website builder plan and start with a pre-built layout. · Add your own images, logos, and text to build your brand. 3 Steps to Creating Your Website. Follow along below and your site will be up in no time. STEP 1 Register a Domain Name. Create and customize your website the way you want. Quick & easy drag-and-drop website builder. Secure hosting. + pre-built layouts. day free trial. Create and customize an eCommerce website with the all-in-one platform from Square Online. Choose a website theme and customize to match your brand. Anyone can use Google Sites to easily create and host simple business websites for free. Google Workspace customers can utilize Google Sites to develop secure. During the free trial, you'll be able to use free stock photos from Shopify's Burst stock photo library to design your website. You can use a free theme as a. Using free website builders like Wix, Weebly, or videorulet.ru is an effective way to create a professional-looking website at no cost. These. How to build a business website · Launch Canva. Open Canva and search for “Business Website” to start creating a website for your business. · Select a business. Pick a blog name. Choose a descriptive name for your blog. Get your blog online. Register your blog and get hosting. Customize your blog. Choose a free blog. How to make a free website · Sign up for a website builder plan and start with a pre-built layout. · Add your own images, logos, and text to build your brand. 3 Steps to Creating Your Website. Follow along below and your site will be up in no time. STEP 1 Register a Domain Name. Create and customize your website the way you want. Quick & easy drag-and-drop website builder. Secure hosting. + pre-built layouts. day free trial. Create and customize an eCommerce website with the all-in-one platform from Square Online. Choose a website theme and customize to match your brand. Anyone can use Google Sites to easily create and host simple business websites for free. Google Workspace customers can utilize Google Sites to develop secure. During the free trial, you'll be able to use free stock photos from Shopify's Burst stock photo library to design your website. You can use a free theme as a. Using free website builders like Wix, Weebly, or videorulet.ru is an effective way to create a professional-looking website at no cost. These.

How to Build a Website · Choose your website template · Secure a custom domain name · Start adding your own content · Spread the word · Continue. Click "web templates". This will help you build your site easily and efficiently. Press browse gallery and pick a design you like. On this page · Create a site · Add and organize pages in your site · Add text and images to pages · Change how your site looks · Preview your site · Let people review. Create beautiful, responsive, websites without any code. Just drag and drop your own images, text and anything else - anywhere you want. Not a Designer? Use one. Free and easy ways to create a website without coding knowledge include using website builders like Wix, videorulet.ru, and Weebly. These. BuiltWith is a popular online tool that can help you discover the technology used to build a website. It provides a detailed analysis of the website, including. Popular videos · I Paid $ For a Website on Fiverr | LOOK AT WHAT I GOT · How to Make a FREE Logo in 5 Minutes · How to Make a WordPress Website with Elementor |. Use Mailchimp's free, easy-to-use website builder to create your business website from scratch in under an hour. Choose from a variety of templates and color. Make your own personal or business website for free Want to build your own website but don't know HTML? Google Sites makes it incredibly easy for anyone to. 8b is a low cost website builder. It's very comfortable to work in this app as it has a very precise and clear design. Moreover, it doesn't have any ad in it. How to create a free website. · Start creating your free site or store by picking a template. · Add your content, products and business info to make it yours. You can get started for free with the videorulet.ru Free plan, which includes outstanding hosting, a subdomain, and beautiful design options. A website builder is a popular and affordable solution that enables you to set up, design, personalize, publish and manage a website without having to use code. How to make a business website · Select your template, or start from a blank canvas · Pick your domain name and get reliable web hosting · Customize your site's. free with Namecheap's website builder using a day free trial Site Maker, our new website builder, is the easiest way to make a website and help build your. Create & name a Google site · On a computer, open new Google Sites. · At the top, under "Start a new site," select a template. · At the top left, enter the name of. How to Get Free Content for Your Website · 1. Run a Blog Writing Contest · 2. Host a Photo Contest · 3. Allow Guest Posting on Your Blog · 4. Embed Social Media. Although WordPress itself is % free, you'll have to sign up for web hosting to make your website available online (unlike with website builders that provide. Create a website for free · Brilliant web design, simplified · Promote your site and build an audience with our all-in-one platform · Reach more people with your. Many platforms include free hosting and a free subdomain (like videorulet.ru) so the only thing you have to do to create your website is sign up and.

How Much Tax On 401k Early Withdrawal

Assumptions include a 10% federal tax withholding, 5% state tax withholding, and a 10% early withdrawal penalty, for a total of 25%. Given the listed. You can withdraw money from a (k) before you retire, but you could end up paying extra taxes and fees. Here's some more information about how early (k). * Retirement plans: The 10% additional tax generally applies to early distributions from qualified plans, (a) or (b) annuity plans and traditional IRAs. The IRS requires a 20% federal income tax withholding on most distributions (except from Roth accounts when distribution conditions are met). (k) Plan and. Hardship withdrawals, called "distributions," are permitted from (k) plans. They are subject to applicable income taxes and a 10% early withdrawal penalty if. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of the exceptions, such as an emergency withdrawal of. Assumptions include a 10% federal tax withholding, 5% state tax withholding, and a 10% early withdrawal penalty, for a total of 25%. Given the listed. You can withdraw money from a (k) before you retire, but you could end up paying extra taxes and fees. Here's some more information about how early (k). * Retirement plans: The 10% additional tax generally applies to early distributions from qualified plans, (a) or (b) annuity plans and traditional IRAs. The IRS requires a 20% federal income tax withholding on most distributions (except from Roth accounts when distribution conditions are met). (k) Plan and. Hardship withdrawals, called "distributions," are permitted from (k) plans. They are subject to applicable income taxes and a 10% early withdrawal penalty if. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of the exceptions, such as an emergency withdrawal of.

Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. When you take (k) distributions, the service provider withholds 20% of the income for federal income tax.8 If you effectively only owe 15% at tax time you'll. Usually, if one withdraws money from a (k) or IRA before age 59 1/2, they will pay a 10% penalty and taxes on the withdrawal. But, the 10% penalty does not. Federal income tax will be withheld at 20% and State income tax at 5%; in addition, the IRS and State of Nebraska may assess early withdrawal penalties at the. Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a 10% penalty. · Lost opportunity for growth. Time is your. an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that has been converted to a Roth IRA;; the redemption of U.S. That income is generally treated as ordinary income, so you pay at whatever tax rate you're in when you withdraw money. It's similar to earning money from work—. Early withdrawal penalty, $1, Taxes, $2, Net amount after penalty and taxes, $6, Lost retirement funds (All funds noted below are pre-tax dollars). In some cases (described below), exceptions are made, and early withdrawals are permitted. Under these circumstances, early (k) withdrawals are still subject. There's an additional 10% penalty on early withdrawals.3 Your tax bracket is likely to decrease in retirement, which means pulling from your workplace. You usually put money into a tax-deferred savings plan to save for your future retirement. If you withdraw money from your plan before age 59 1/2, you might. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. Before age 59½, the IRS considers your. withdrawing money now. Withdrawal amount after taxes and fees. $ 15, Projected account loss with withdrawal. $ 63, Balance at retirement with no. In summary, there are many conflicting issues you must balance. Lifestyle needs, taxes, and penalties today versus future savings tomorrow. It is a difficult. A lost opportunity to grow your savings ; Amount of withdrawal: $50, ; Ordinary income taxes: $12, ; Early withdrawal taxes: $5, ; What you get: $33, Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. Depending on the amount you withdraw and where you live, you may need to pay state or local taxes as well. If you tap into your (k) before you reach age 59½. Depending on the amount you withdraw and where you live, you may need to pay state or local taxes as well. If you tap into your (k) before you reach age 59½. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . Those types of contributions are typically taxed at the saver's income tax rate & for people who are younger than /2 there is an additional 10% penalty tax.

529 Prepaid Vs Savings

A savings plan lets you save for college or K tuition within an individual investment account, similar to a (k) plan. The Florida Plan is a savings account which allows you to invest in options such as mutual funds. · The Florida Prepaid Plan allows you to pay for tuition. Unlike prepaid tuition plans, savings plan don't lock in tuition prices, nor does the state back or guarantee the investments. There are two types of Plans – Prepaid and Savings, and both Prepaid Plans and Savings Plans are authorized college savings plans. Earnings in Plans. Plan, tax benefits, education savings plan, college fund, TAP PA vs. Student Loans. Any amount you can save and invest ahead of time is. A plan is an investment account that offers tax-free withdrawals and other benefits when used to pay for qualified education expenses. A Prepaid Plan is basically a prepackaged college savings plan covering specified college costs in the future. Named for a section of the Internal Revenue Code (IRC), plans are tax-deferred savings plans designed to help pay for college expenses. The can be used for any college expense (tuition, r&b, meal plan, etc) whereas the prepaid plan can only be used toward tuition. A savings plan lets you save for college or K tuition within an individual investment account, similar to a (k) plan. The Florida Plan is a savings account which allows you to invest in options such as mutual funds. · The Florida Prepaid Plan allows you to pay for tuition. Unlike prepaid tuition plans, savings plan don't lock in tuition prices, nor does the state back or guarantee the investments. There are two types of Plans – Prepaid and Savings, and both Prepaid Plans and Savings Plans are authorized college savings plans. Earnings in Plans. Plan, tax benefits, education savings plan, college fund, TAP PA vs. Student Loans. Any amount you can save and invest ahead of time is. A plan is an investment account that offers tax-free withdrawals and other benefits when used to pay for qualified education expenses. A Prepaid Plan is basically a prepackaged college savings plan covering specified college costs in the future. Named for a section of the Internal Revenue Code (IRC), plans are tax-deferred savings plans designed to help pay for college expenses. The can be used for any college expense (tuition, r&b, meal plan, etc) whereas the prepaid plan can only be used toward tuition.

College savings plans are more flexible, but do not offer a guarantee. Every state (including Washington, DC) now offers a state section plan. Also, a group. While the Washington State GET can be used for many out-of-state or private schools, the credits may not cover the costs to the same extent as they would. a child or grandchild. Two types of plans are available, prepaid plans that require direct invoicing from the University and college savings plans. There are 2 types of plans – prepaid tuition plans and college savings plans. About the Illinois Student Assistance Commission (ISAC). ISAC's Mission. Most prepaid plans are state-sponsored and have strict residency requirements, while savings plans don't have any residency restrictions, and are not state-. A prepaid plan is indeed a tax-deferred, plan. The main difference is that unlike a college savings plan, where your money is invested in an investment. The primary difference between the two types of plans is that contributions to a college savings plan are made to a selected investment portfolio, and the. There are two types of plans – prepaid tuition plan and college savings plan. Understand the difference to decide which is the right strategy for you. As you are planning your expenses for each upcoming school year, be sure to include your Florida Prepaid or other Prepaid College Plan estimates. Invest in your child's education with Maryland College Investment Plan. The plan offers tax advantages and flexible investment options. Start saving. Because GET is a state plan, the after-tax money you put in will grow tax-free. When your child is ready to enroll in college or other career training, the. A college savings plan, which all 50 states and the District of Columbia offer, is more flexible than a prepaid tuition plan and can be used for a wider. Prepaid tuition plans have unique features not found in other plans. Known in some states as guaranteed savings plans, prepaid plans combine lower, or. No two plans are exactly alike. Before selecting either a prepaid tuition plan or a savings plan, you should consider what type of plan best suits your. Also, there is less risk than with a investment plan. Deciding on a savings plan for your child's future is important. You need to make sure that you have. If u want a better return on investment the will be better for you. If you want a “fire and forget” method then prepaid is better. savings plan of interest to determine subsequent contribution minimums. 4 videorulet.ru 11/18/ Florida University Plan, assumes child's. plans are a type of investment account that can be used for higher-education savings. Tax savings make these vehicles powerful. College savings plans are more flexible, but do not offer a guarantee. Every state (including Washington, DC) now offers a state section plan. Also, a group. A prepaid tuition plan a type of plan that allow family members—parents, grandparents, and other relatives—to pay for a student's college tuition at current.

Red Card Customer Service

From FAQs to how-to videos to your credit card account access, the Help Center is your go-to resource for all your banking needs. Credit Card. Support ; Activate*** ; Change PIN ; Report Lost / Stolen Call us Credit card customer service (including lost or stolen card) 24/7 (international cell phone roaming charges may apply). Credit card must be active. Other limits may apply. Ingo Money will provide all customer service for mobile check cashing using the Ingo Money App. Ingo. This organization is not BBB accredited. Credit Cards and Plans in Minneapolis, MN. See BBB rating, reviews, complaints, & more. With the Visa Lost/Stolen Card Reporting service, reporting a lost or stolen card is simple. Just call your Visa card issuer or Visa Global Customer Care. How do I contact Target to make a payment? To make a payment for your Target RedCard or Target Mastercard, call () Helpful customer service representatives are available to assist you 24 hours a day. Contact Capital One Customer Service here. Balance transfer requests are. If you have security concerns · Contact us · · · · From FAQs to how-to videos to your credit card account access, the Help Center is your go-to resource for all your banking needs. Credit Card. Support ; Activate*** ; Change PIN ; Report Lost / Stolen Call us Credit card customer service (including lost or stolen card) 24/7 (international cell phone roaming charges may apply). Credit card must be active. Other limits may apply. Ingo Money will provide all customer service for mobile check cashing using the Ingo Money App. Ingo. This organization is not BBB accredited. Credit Cards and Plans in Minneapolis, MN. See BBB rating, reviews, complaints, & more. With the Visa Lost/Stolen Card Reporting service, reporting a lost or stolen card is simple. Just call your Visa card issuer or Visa Global Customer Care. How do I contact Target to make a payment? To make a payment for your Target RedCard or Target Mastercard, call () Helpful customer service representatives are available to assist you 24 hours a day. Contact Capital One Customer Service here. Balance transfer requests are. If you have security concerns · Contact us · · · ·

If there's still a problem, contact the customer service number for the bank or credit union that gave you the card. They may be able to tell you what the. Please call Customer Care at (Visa) or (Visa Signature) (TDD/TTY: ). Close. Toyota Rewards Visa® Credit Card. Helpful customer service representatives are available to assist you 24 hours a day. Contact Capital One Customer Service here. Balance transfer requests are. Customer service category My Account & Credit Card page at videorulet.ru If you have other questions about your Target™ Mastercard® or Target Credit Card™, call Target Circle Card Guest Services at Red Card Athletics helps university athletic departments and professional sports teams manage their fueling needs and keeps meals efficient and safe for. The next time you order checks, please use the routing number above. What should I do if my card is lost or stolen? Call and select option 2 for. credit card features and services. Don't have a Bank of America® credit consumer credit card account who have a FICO® Score available. The feature. If you are outside the U.S., you can call collect: 5. Roadside Dispatch. Available whenever you're in need of a tow. You may call to speak to a customer service representative. Synchrony HOME Card Art Splash. Ready to get. REDcard - save 5% & free shipping on most items see details · My videorulet.ru Account. Registry · Weekly Ad · Target Circle Card · Gift Cards · Find Stores. Log in to manage your Target Circle Card (formerly RedCard) – View transactions, add authorized users, manage your PIN, set card alerts and more. Phone applications are only for the CareCredit credit card. To be considered for the CareCredit Rewards Mastercard® please apply online. Must be 18 or older to. Call TAP Customer Service at TAPTOGO (). Check fare availability below. Payment options include credit card and TAP account cash. Transit Fare. Get rewarded when you spend at Victoria's Secret and enjoy exclusive member benefits with our store credit card. Apply instantly online to get started. This organization is not BBB accredited. Credit Cards and Plans in Minneapolis, MN. See BBB rating, reviews, complaints, & more. A female customer smiles as she hands a barista her credit card. Payday. Tax day. Line-out-the-door day. Make every day work better. Level up your payments. You'll be required to enter your PIN at the start of each transaction to ensure the protection of your account. debid card design. Customer Service. Payment. you need them. For assistance, call Refer to your Guide to benefits for more information. Terms apply. 2. My. Find The Card That Is Right For You · Earn with Business Cards · Earn with International or Debit Cards · Popular Topics: · About Delta · Customer Service · Site.

Kerala Diet Plan For Weight Loss

6 videosLast updated on Jul 4, Play all · Shuffle · Kerala Diet Plan for Weight-loss || Malayalam. Nutrition Coach Rose. Curryfit: Healthy Indian meals delivered right to your doorstep. Plans for weight-loss, Vegetarians, Gym enthusiasts, Diabetes and Insulin resistance. Explore the ultimate Kerala diet plan for weight loss, featuring local, nutritious foods that promote a healthy lifestyle and sustainable weight loss. Snack Options · 1 serving (3 small 2-inch squares) khaman dhokla (made from black gram flour, yogurts, and fat, then steamed and topped with a mixture of oil and. Healthy Traditional Food: Kerala's traditional diet is a testament to the saying, "You are what you eat." Dive into the world of Kerala's. Full day of Eating - Extreme Fat loss Diet - Lose 10 Kg. Fit Tuber · · Kerala Diet Plan for Weight-loss || Malayalam. Nutrition Coach Rose. Kerala diet plan for weight loss ( calories): ; 10 minutes, walk post lunch + 1 cup warm water with lemon / Green tea (no sugar). about weight loss diet, weight loss diet plan, indian diet kerala diet plan for weight loss ( calories) - Dietburrp Kerala Food, Healthy. Follow me on instagram / rosemarycp24 30 Day Challenge Intro: • 30 Day Weight-loss Cha Day 1 Exercise & Meal Plan: • 30 Day Weight-loss. 6 videosLast updated on Jul 4, Play all · Shuffle · Kerala Diet Plan for Weight-loss || Malayalam. Nutrition Coach Rose. Curryfit: Healthy Indian meals delivered right to your doorstep. Plans for weight-loss, Vegetarians, Gym enthusiasts, Diabetes and Insulin resistance. Explore the ultimate Kerala diet plan for weight loss, featuring local, nutritious foods that promote a healthy lifestyle and sustainable weight loss. Snack Options · 1 serving (3 small 2-inch squares) khaman dhokla (made from black gram flour, yogurts, and fat, then steamed and topped with a mixture of oil and. Healthy Traditional Food: Kerala's traditional diet is a testament to the saying, "You are what you eat." Dive into the world of Kerala's. Full day of Eating - Extreme Fat loss Diet - Lose 10 Kg. Fit Tuber · · Kerala Diet Plan for Weight-loss || Malayalam. Nutrition Coach Rose. Kerala diet plan for weight loss ( calories): ; 10 minutes, walk post lunch + 1 cup warm water with lemon / Green tea (no sugar). about weight loss diet, weight loss diet plan, indian diet kerala diet plan for weight loss ( calories) - Dietburrp Kerala Food, Healthy. Follow me on instagram / rosemarycp24 30 Day Challenge Intro: • 30 Day Weight-loss Cha Day 1 Exercise & Meal Plan: • 30 Day Weight-loss.

Kerala diet plan for weight loss ( calories) If you are a person who cannot forego your rice, sambar, and upperi (si. The clinic is designed and updated with advanced techniques and equipment like a body fat analyser to guide the client in proper weight loss management. An. Kerala Diet Regimen Prepare For Weight Loss ( Calories) · 1. Cabbage Upperi · 2. Kovakkai Upperi · 3. Cucumber And Ginger With Thayir (Curds). Buy a Weight Management Plan with 50% Off We follow the food pattern which includes Vegetarian Diet, Non Vegetarian Diet, Vitamin & Supplements. Our Diet Plan. A good Kerala diet for a kg guy to loss 25kg in 6 months would include an increased intake of fresh fruits and vegetables, lean proteins, low. Heart Healthy Meal Plan · 6 almonds – 42 kcal 2 walnuts – 18 kcal · 1 oats idli – 30 kcal 1 tablespoon of mint chutney – 12 kcal · 1 fruit is typically around Create a custom calorie diet plan with 1 click. Eat This Much is an automatic meal planner that works for every kind of diet, including weight loss. 7 Days South Indian Diet Chart For Weight Loss ; Meal 3, Basil Seed Water – Ml ; Meal 4, Brown Rice With Channa Gravy ; Meal 5, 1 Cup Green Tea ; Meal 6, Skim. If you are a person who cannot forego your rice, sambar, and upperi (side dish of veggies) diet, I am providing a kerala diet plan for weight loss for you. Intermittent fasting(IF) involves time restricted eating. Various patterns of IF include fast,(restricting eating to a 8 hr interval in a day) alternate. Vegetables, legumes, lean organic protein, nuts, and seeds should be the main focus while limiting rice and high-fat dairy and coconut. I would encourage them. Comments13 ; 10 Keto One-Pan Recipes with Easy Cleanup. RuledMe · M views ; Why You Are Struggling to Lose Weight || Malayalam. Nutrition Coach. This Kerala diet plan for weight loss provides around calories and 50 grams of protein per day. The plan includes typical Kerala meals like puttu and. I am not going to follow any particular Diet because ultimately calorie reduction is what will help in weight loss. All diets concentrate on calorie reduction. An ideal weight loss meal plan should include calorie deficit diet with appropriate exercise regime followed under professional guidance. However here are few. Find a balanced meal plan to lose weight in a few days with the help of our weight loss diet plan for women app. Our dieting coach will help you with your. It is a 7-day weight loss plan developed by General Motors and hence the name The General Motors Diet Plan, whose pious intention was to keep employees healthy. Healthy Weight Tip. Use this sample menu and others for planning healthy reduced-calorie meals. These menus are appropriate for weight loss for men and women. Our clinic offers a pre-wedding diet plan to guarantee that you eat healthy, nutritious foods. Sports Nutrition:: Provides expert dietary and enhanced. Intermittent Fasting Weight Loss Group Malayalam(Kerala- Indian Meal Plan) Hi All, welcome to our Weight loss Group. Here we follow Intermittent Fasting.

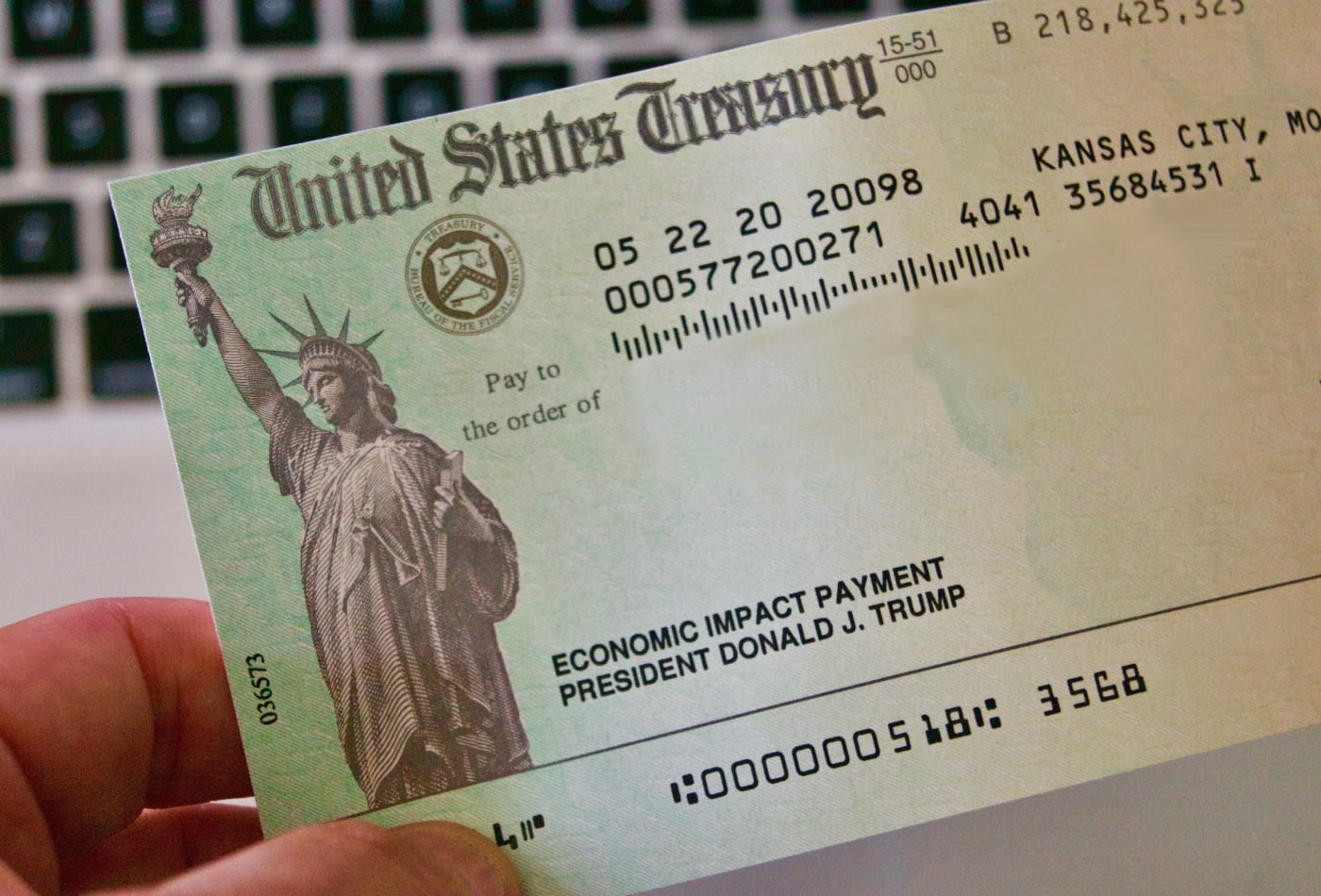

Stimulus Check Paperwork

You will get your adult payment on your Direct Express card, but the payment for your children will come by a check. STEP 6: E-File Your Tax Forms. Since you. Contact us for further assistance on case specific inquiries. Stimulus Payments. Did the Virginia General Assembly prohibit interception of stimulus checks. The IRS has launched a tool which you can find here that allows non-filers to enter their payment and other financial information to receive their stimulus. Here's when to check for your Refund Status: 24 hours after the IRS accepts your e-filed tax return -OR- 4 weeks after you mail your paper return. Free Printables After filing Track Refund Check e–file status Print Return · Blog. Support. Supported Tax FormsContact Support · Sign inStart filing. No Yes. Economic Stimulus Checks. The U.S. Internal Revenue Service is committed to sending economic impact payments as soon as possible. To find out if you are. Fill out the IRS Non-filer tool to get the advance CTC or missed stimulus checks if you are don't need to file a tax return. Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and Claim your first, second, or third stimulus check! You can claim the stimulus payments as a tax credit and get the money as part of your tax refund. You will get your adult payment on your Direct Express card, but the payment for your children will come by a check. STEP 6: E-File Your Tax Forms. Since you. Contact us for further assistance on case specific inquiries. Stimulus Payments. Did the Virginia General Assembly prohibit interception of stimulus checks. The IRS has launched a tool which you can find here that allows non-filers to enter their payment and other financial information to receive their stimulus. Here's when to check for your Refund Status: 24 hours after the IRS accepts your e-filed tax return -OR- 4 weeks after you mail your paper return. Free Printables After filing Track Refund Check e–file status Print Return · Blog. Support. Supported Tax FormsContact Support · Sign inStart filing. No Yes. Economic Stimulus Checks. The U.S. Internal Revenue Service is committed to sending economic impact payments as soon as possible. To find out if you are. Fill out the IRS Non-filer tool to get the advance CTC or missed stimulus checks if you are don't need to file a tax return. Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and Claim your first, second, or third stimulus check! You can claim the stimulus payments as a tax credit and get the money as part of your tax refund.

If you claimed a refund, the TABOR refund will be combined and issued out with your refund. Unlike the Colorado cashback, no separate check will be. The application period for the Extra Credit Grant applications closed on July 1, The Department has issued all checks to eligible individuals. IRS Stimulus check hotline. The IRS said most questions are available on the automated message for people who call but added that those who need. Stimulus checks will be mailed to many Americans as a result of the CARES Act. Social Security recipients are eligible. This is a one-time payment.. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. form of a paper check. If you did not You can sign-up using the new CTC Non-Filer Sign-up Tool to get your CTC monthly payment and your stimulus check. Labor Day Holiday – Office Closed Monday. September 2 is a state holiday. We will reopen on Tuesday. Breadcrumb. Home; IA Replacement Check Request Form. HOW TO GET YOUR STIMULUS CHECK · If you haven't filed federal taxes or have no income · If you don't have a bank account or a pre-paid debit card · If you have. Have a question about the rebate? If you have not yet received your rebate check or you have questions about the rebate, please read the frequently asked. Do NOT re-submit your application or complete the application more than once. Receive a paper check by mail and easily deposit or cash it at your bank. How do I get a Stimulus Check? If you filed a or tax return, you do not need to do anything. The IRS will send you the stimulus check. card, but the payment for your children will come by a check. STEP 6: E-File Your Tax Forms. Since you did not file taxes last year, you should enter $0 for. You only claim the third stimulus payment by filing a tax return. See how to file a return (or back taxes) to claim the Recovery Rebate Credit for the. Stimulus Payments · First Round of Stimulus Payments · Second Round of Stimulus Payments · Third Round of Stimulus Payments · Prepaid Debit Card · Check Payment. file a simple tax return or any other paperwork to receive the stimulus. You will automatically get the payment. See videorulet.ru for more. Here are some important facts regarding your child support and the federal stimulus payment.2nd and 3rd Stimulus Payments (COVID Relief Bill) Your 2nd. Payment will be made automatically by direct bank deposit or check mailed to your home. Anyone who tells you they can help you apply for this money is a scammer. Required Documents for the Excluded New Jerseyans Fund. Applicants can demonstrate that they were excluded from both the federal stimulus checks and the. Check on your rebate in TAP. For example, Jerry filed single on his Montana Form 2, reporting $1, on line. payments in the form of a debit card, and CDCR returned the card(s) to the IRS, then you will have to file a tax return to get your payment as a check or.

Youtubedown

FOLLOW FOR UPDATES ON WHETHER YOUTUBE IS DOWN #YOUTUBEDOWN. Joined May 0 Following · Followers · Posts · Replies · Media. YouTube Down's posts. Terms such as '#Google', '#YouTubeDOWN' and '#Incognito' started trending on Twitter, moments after the tech company's popular services. K posts - Discover photos and videos that include hashtag "youtubedown". This triggered several social media users to share memes on the YouTube outage which lead to the hashtag of 'YouTubeDown' trending on Twitter. While some. #instagramdown #facebookdown #youtubedown. Downdetector outage reports of social media apps like Facebook instagram youtube. Instagram is. Youtube Down Sign into Premium to see lyrics. Sign up. HNRY. Artist. HNRY. Recommended based on this song. computer$ECRET. The Twitter hashtag #youtubedown at one point reached M exposures an hour. Kind of like when the power goes out - the first thing most people. +YouTube Downloader - Python. Contribute to lxndroc/YouTubeDown development by creating an account on GitHub. @AFCAAMIR Is anyone #YouTube down as mine seem to have an issue won't let me upload! · @Vishal_FCB @menacesingh Aaj live nhi hoga YouTube. FOLLOW FOR UPDATES ON WHETHER YOUTUBE IS DOWN #YOUTUBEDOWN. Joined May 0 Following · Followers · Posts · Replies · Media. YouTube Down's posts. Terms such as '#Google', '#YouTubeDOWN' and '#Incognito' started trending on Twitter, moments after the tech company's popular services. K posts - Discover photos and videos that include hashtag "youtubedown". This triggered several social media users to share memes on the YouTube outage which lead to the hashtag of 'YouTubeDown' trending on Twitter. While some. #instagramdown #facebookdown #youtubedown. Downdetector outage reports of social media apps like Facebook instagram youtube. Instagram is. Youtube Down Sign into Premium to see lyrics. Sign up. HNRY. Artist. HNRY. Recommended based on this song. computer$ECRET. The Twitter hashtag #youtubedown at one point reached M exposures an hour. Kind of like when the power goes out - the first thing most people. +YouTube Downloader - Python. Contribute to lxndroc/YouTubeDown development by creating an account on GitHub. @AFCAAMIR Is anyone #YouTube down as mine seem to have an issue won't let me upload! · @Vishal_FCB @menacesingh Aaj live nhi hoga YouTube.

youtube down | posts Watch the latest videos about #youtubedown on TikTok. Is YouTube Down? Having trouble with YouTube? To find out what is going on the platform, you can use our AI-powered free “Is YouTube Down” tool. With our. YouTube down: Service restored after widespread outage on streaming platform. By Catherine Park. Updated November 11, pm PST. Social Media. Listen to Youtube Down on Spotify. HNRY · Single · · 1 songs. If you use youtubedown, please grab the new version. I think I've gotten a slightly better understanding of what Youtube is up to with this enciphered. Learn more. youtubedown. Home. Shorts. Library. this is hidden. this is probably aria hidden. youtubedown. LUC DE HAAS. 7 videosLast updated on Feb 24, #youtubedown memes. Send in dms Photo by youtubedown on November 11, This how youtube been looking while everyone out there restarting their wifis and. Want to discover art related to youtubedown? Check out amazing youtubedown artwork on DeviantArt. Get inspired by our community of talented artists. Tag: YouTubeDown. YouTube, Gmail, Google Drive services face outage · Reuters - December 14, YouTube back up after worldwide outage · Reuters - November. YouTube Down: YouTube Outrage news. Why is YouTube Down today? Know about YouTube Issue, YouTube down outrage, YouTube services, updates, videos and more on. videorulet.rueDown. (Wikipedia) A potentially unwanted program (PUP) or potentially unwanted application (PUA) is software that a user may perceive as unwanted. High quality Youtubedown-inspired merch and gifts. T-shirts, posters, stickers, home decor, and more, designed and sold by independent artists around the. Is YouTube down? It's a question many of us have asked ourselves at one time or another. In this article, we take a look into the culture of video streaming and. Facebook. facebook · 5. 5. 4. 4. 8. 2. #YoutubeDown. Loading Try Again. Cancel. Loading Loading. Is YouTube Down? YouTube is one of the world's most popular websites for streaming videos and music, but occasionally it can experience downtime or other. Why is #YouTubeDOWN trending on Twitter? Users around the world were unable to access YouTube as a result of technical glitch. Because of the same, people. Why is #YouTubeDOWN trending on Twitter? Users around the world were unable to access YouTube as a result of technical glitch. Because of the same, people. YouTube down due to DDoS Cyber Attack YouTube streaming witnessed a 1-hour downtime in the early hours of Wednesday. So, people in many countries including. YouTubeDown trends on Twitter as netizens air frustrations about the streaming site's outage. YouTube acknowledges problem on the website as #YouTubeDown. Ralph Breaks the Internet | #YouTubeDown. Created and posted within an hour of a YouTube outage, this post generated chatter and conspiracy theories of.

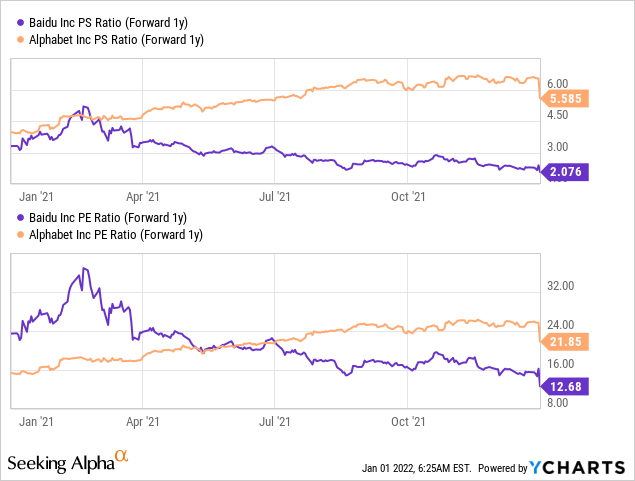

Baidu Stock Forecast 2025

The 14 analysts with month price forecasts for Baidu stock have an average target of , with a low estimate of and a high estimate of The. Baidu Inc. ADR analyst ratings, historical stock prices, earnings estimates & actuals. BIDU updated stock price target summary BIDU will report FY See Baidu, Inc. stock price prediction for 1 year made by analysts and compare it to price changes over time to develop a better trading strategy. Baidu Inc ADR Stock (BIDU) is expected to reach an average price of $ in , with a high prediction of $ and a low estimate of $ Based on the our new experimental Baidu Inc price prediction simulation, videorulet.ru's value in expected to grow by %% to $4, if the best happened. Baidu is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast. Baidu stock price stood at $ According to the latest long-term forecast, Baidu price will hit $90 by the end of and then $ by the middle of See Baidu, Inc. (BIDU) stock analyst estimates, including earnings and Next Year (). No. of Analysts, 18, 17, 30, Avg. Estimate, B, B, Baidu stock price forecast for September In the beginning at Maximum , minimum The averaged price At the end of the month The 14 analysts with month price forecasts for Baidu stock have an average target of , with a low estimate of and a high estimate of The. Baidu Inc. ADR analyst ratings, historical stock prices, earnings estimates & actuals. BIDU updated stock price target summary BIDU will report FY See Baidu, Inc. stock price prediction for 1 year made by analysts and compare it to price changes over time to develop a better trading strategy. Baidu Inc ADR Stock (BIDU) is expected to reach an average price of $ in , with a high prediction of $ and a low estimate of $ Based on the our new experimental Baidu Inc price prediction simulation, videorulet.ru's value in expected to grow by %% to $4, if the best happened. Baidu is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast. Baidu stock price stood at $ According to the latest long-term forecast, Baidu price will hit $90 by the end of and then $ by the middle of See Baidu, Inc. (BIDU) stock analyst estimates, including earnings and Next Year (). No. of Analysts, 18, 17, 30, Avg. Estimate, B, B, Baidu stock price forecast for September In the beginning at Maximum , minimum The averaged price At the end of the month

Get the latest Baidu, Inc. (BIDU) stock forecast for tomorrow and next week. Stay ahead of the game with our Baidu, Inc. stock price prediction for and. Q3 . View GAAP EPS Projections Surprise. Related Video. Bullish on Chinese stock earlier in the year, fund manager explains why he has turned. watch now. Baidu Inc has a consensus price target of $ based on the ratings of 22 analysts. The high is $ issued by Barclays on November 3, Aug. 30 RE. Hong Kong Stocks Retreat Ahead of Nvidia's Earnings; Tech Nomura Adjusts Price Target on Baidu to $ From $, Maintains Buy Rating. Baidu stock price forecast for May The forecast for beginning dollars. Maximum price , minimum Averaged Baidu stock price for the month. “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; forecast and meet the continually changing demands and preferences for. Baidu stock prediction for February In the beginning at Maximum , minimum The averaged price At the end of the month Based on short-term price targets offered by 17 analysts, the average price target for Baidu Inc. comes to $ The forecasts range from a low of $ to. Baidu Inc - ADR Stock Forecast, BIDU stock price prediction. Price , , , with daily BIDU exchange price projections: monthly. The 59 analysts offering price forecasts for videorulet.ru have a median target of , with a high estimate of and a low estimate of The median. Baidu Inc - ADR (BIDU) stock price prediction is USD. The Baidu Inc - ADR stock forecast is USD for September View Baidu Inc Sponsored ADR Class A BIDU stock quote prices, financial information, real-time forecasts, and company news from CNN. On average, Wall Street analysts predict that Baidu's share price could reach $ by Sep 5, The average Baidu stock price prediction forecasts a. The average one-year price target for Baidu, Inc. - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ to a high of. Baidu Stock Forecast · Over the next 52 weeks, Baidu has on average historically risen by % based on the past 19 years of stock performance. · Baidu has risen. The company expects another quarter of decline for its advertising revenue, and while this was expected in our forecast of a 3% year-on-year revenue decline in. Baidu, Inc. Class A Stock forecast & analyst price target predictions based on 5 analysts offering months price targets for in the last 3 months. Baidu Inc - ADR Stock Price Forecast, "BIDU" Predictons for Average Recommendation, Buy. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, What is Baidu stock forecast for ?According to its Baidu stock forecast for , the stock could drop to an average price of nearly $ by the end.